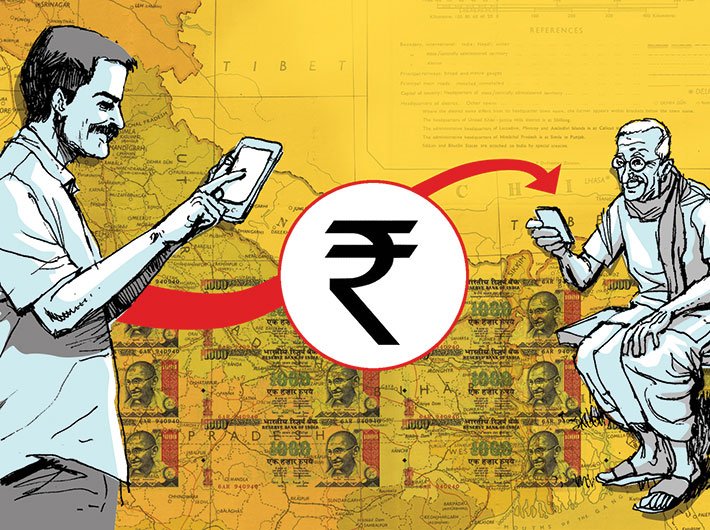

Along with top billing comes added risks or bets. Since, we know that Unified Payment Interface(UPI) is to be launched on 11th April,2016 from Mumbai, what are the chances that it will outsmart other avenues of payment.

National Payments Corporation of India(NPCI) along with RBI has taken a great leap of faith. If they succeed it would herald a new era. Otherwise there would be egg on the face of Mr. Rajan(RBI gov) and Mr. A P Hota(Chairman, NPCI).

As has been seen in history fortune favors the rich. Facebook's success was partly because everyone wanted to be in friendly terms with people of Harvard or in anyway connected to them.

National Payments Corporation of India(NPCI) along with RBI has taken a great leap of faith. If they succeed it would herald a new era. Otherwise there would be egg on the face of Mr. Rajan(RBI gov) and Mr. A P Hota(Chairman, NPCI).

As has been seen in history fortune favors the rich. Facebook's success was partly because everyone wanted to be in friendly terms with people of Harvard or in anyway connected to them.

In payments industry this propensity gets turned upside down because we get paid by a rich corporation/government/institution and we pay relatively poorer people/organizations with our hard earned money. This implies that any payment technology accepted by the poor will win over those meant exclusively for the rich.

Apple Inc is now launching cheaper smartphones, probably to capture the rich-rich payment market. Android Pay and Apple Pay are yet to penetrate and will take longer to

gain acceptance and would in due course of time be competitors of the

UPI.

The landscape has got muddled with the expected launch of payment banks coinciding with the launch of UPI. People get confused with what is what:- like for example what difference exists between payments bank and mobile wallets or what exactly is UPI?

Customer will be the king:

RBI recently took a major step towards reducing non lending activities in branches by giving out licenses to newer kinds of banks. Ten small finance banks and eleven payment bank licenses have been given out. Even predictions about an imminent market shakeup may go astray as no one knows what is in store for the cashless payment industry.

The landscape has got muddled with the expected launch of payment banks coinciding with the launch of UPI. People get confused with what is what:- like for example what difference exists between payments bank and mobile wallets or what exactly is UPI?

Customer will be the king:

RBI recently took a major step towards reducing non lending activities in branches by giving out licenses to newer kinds of banks. Ten small finance banks and eleven payment bank licenses have been given out. Even predictions about an imminent market shakeup may go astray as no one knows what is in store for the cashless payment industry.

Airtel with more than 250 million customers, Vodafone with 200 million and Idea with 175 million can leverage their customer base and capture a large part of the market.

PayTM has received top billing as a wallet having a payment bank license too. It recently launched online shopping app and has crossed 125 million monthly active users. India Post, a sleeping giant has a payment bank license with current branch network more than that of SBI and potential for 10-12 times higher branch network with very wide rural reach. India Post is currently sitting on as many as twenty proposals of tie up with banks to market their products. It can better serve customers of a bank, who stay near to the post office. The transition from postal payment bank to regular bank should be seamless for such customers.

NPCI has provided the platform for the UPI and other platforms like the apple pay and android pay may take time to gain market share. Such platforms may be useful to the frequent fliers and the upwardly mobile who eventually would want their money to be transferred to an Indian Payment Bank account to pay for domestic services. What matters is the platform and not so much on which service player wins.

Customer convenience and trust in the system would help the platform gain acceptance.

Customer convenience and trust in the system would help the platform gain acceptance.

No comments:

Post a Comment